Why Do Consumers Spend More With Cashless Vending Payments Compared to Cash?

You want to maximize revenue from your vending locations. But cash transactions are limiting your customers' spending, tying their purchases to the physical bills and coins they happen to be carrying.

Consumers spend more with cashless payments because it removes the friction and psychological "pain of paying." Since they are not limited by the cash in their pocket, impulse buys and choosing premium, higher-priced options become much easier, leading to a higher average transaction value.

As a factory that builds and helps operate vending machines, I've seen the data firsthand. A machine that only takes cash will have a certain average sale price. The moment you turn on the credit card and mobile payment reader, that average jumps. It's not a small jump, either. It’s a significant increase in revenue. This isn't magic; it's a combination of modern convenience and simple human psychology. People are willing to spend more when the process is easy and doesn't involve the tangible act of handing over physical money. Let's explore why this happens and how you can use this knowledge to make your vending business more profitable.

Why is cashless payment better than cash?

Your customer is excited to buy, but the machine rejects their wrinkled bill or they don't have exact change. They walk away frustrated, and you lose a sale. A simple tap-to-pay system avoids this entire problem.

Cashless payment is better because it is faster, more convenient, and aligns with how people shop today. It removes the need for customers to carry cash or worry about exact change, creating a smooth, quick transaction that encourages purchasing and builds customer satisfaction.

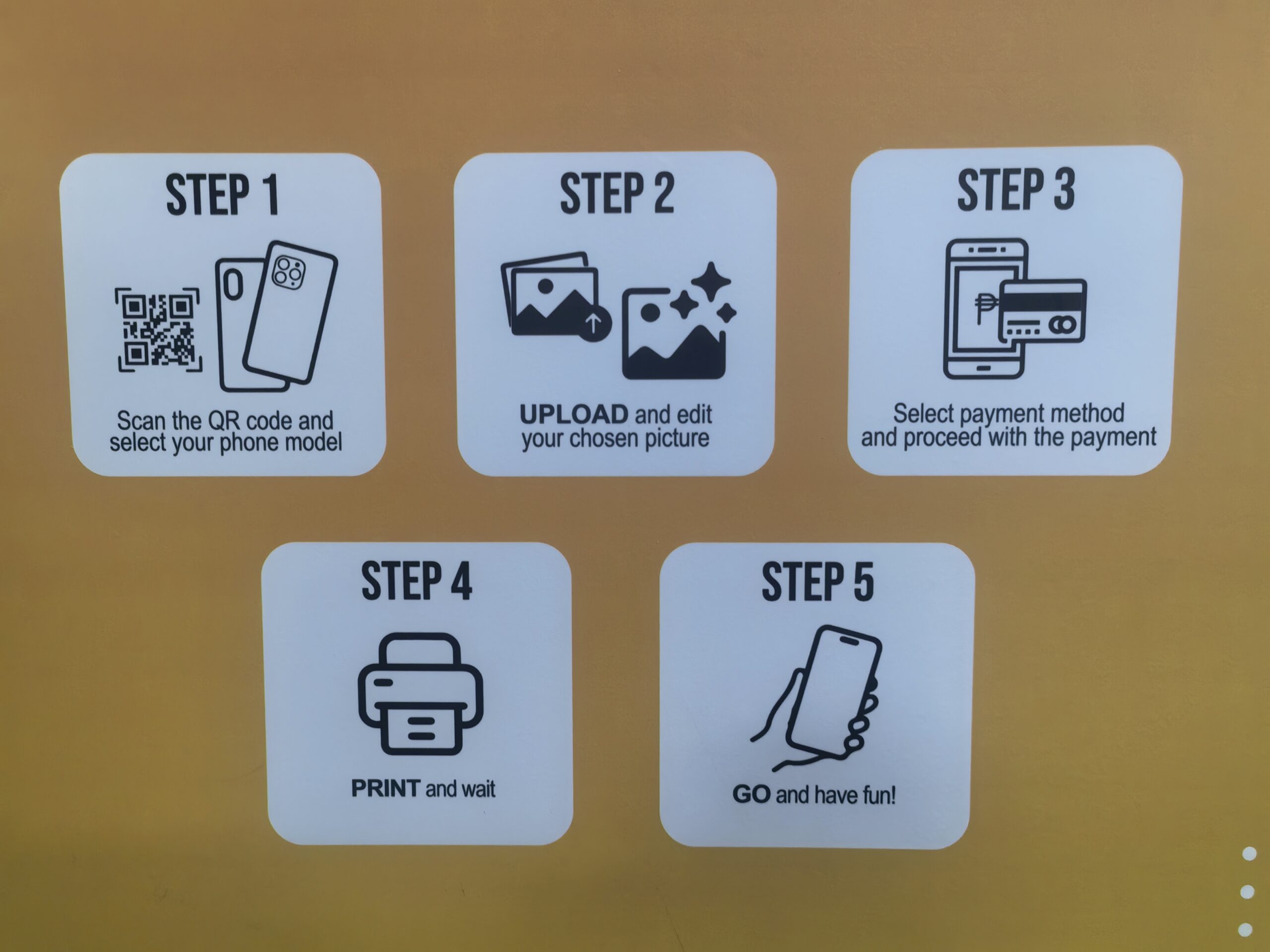

The difference in customer experience is night and day. Think about the steps involved in a cash transaction. A customer has to find their wallet, pull out the right bills, make sure they are not too crumpled, and feed them into the machine one by one. Then they wait for change. Each step adds a little bit of friction and time. With our PrintYOLO phone case machine, the creative process is fun and engaging. The payment should be the easiest part, not a roadblock. A single tap of a card or phone is an effortless end to a fun experience. By removing the hassle, you increase the chances that a customer completes their purchase, especially in high-traffic areas where people value their time.

The Psychology of Effortless Transactions

| Action | With Cash | With Card/Mobile |

|---|---|---|

| Effort | High (Find, straighten, insert, wait) | Low (Single tap or scan) |

| Time | 30-60 seconds | 2-5 seconds |

| Friction Point | Bill/coin rejection, no change | None (Instant approval) |

| Result | Potential for abandoned sale | High conversion rate |

Do people spend more money in a cashless society?

Your vending machine offers a standard product and a premium one. A customer with only a $10 bill in their pocket can only buy the standard option. You're missing out on a potential upsell and higher profit.

Yes, data overwhelmingly shows that people spend more money when they are not using cash. Freed from the physical limitation of the money in their wallet, consumers are more likely to make impulse buys and choose higher-priced, premium options when paying digitally.

This is where it gets really interesting for a business owner. Let's say our PrintYOLO machine offers a standard phone case for $20 and a premium one with a cool 3D embossed texture for $28. A customer who loves the premium design but only has a $20 bill is forced to settle for the standard option. But if that same customer can pay by card, the $8 difference feels insignificant. They will tap their card without a second thought to get the product they really want. We see this with our partners all the time. The moment they introduce a premium option alongside cashless payments, their average transaction value climbs. It's because you are no longer selling based on the cash in their pocket; you are selling based on their desire.

Unlocking Premium Purchases and Upsells

| Payment Method | Customer's Cash | Purchase Decision | Your Revenue |

|---|---|---|---|

| Cash Only | Has a $20 bill | Buys the $20 standard case. | $20 |

| Cashless | Has any amount | Buys the desired $28 premium case. | $28 |

This simple change results in a 40% increase in revenue for that single transaction.

Why do people spend more with credit than cash?

You might think a sale is a sale, regardless of the payment method. But a cash purchase is a calculated decision, while a credit purchase is an emotional one. This difference directly impacts your daily revenue.

People spend more with credit because it feels less "real." The payment is abstract and deferred to a later date. This psychological distance from the money, known as the "decoupling effect," reduces spending inhibitions and makes larger purchases feel more acceptable.

When you hand over a physical $20 bill, you feel it. You see your wallet become lighter. There's a tangible, immediate sense of loss. That's the "pain of paying." Credit cards and mobile wallets almost completely remove this pain. The purchase is a quick, painless tap. The actual payment happens weeks later as part of a larger bill, disconnected from the joy of the purchase. This is incredibly powerful for products that are impulse buys, like a custom-printed phone case. A customer sees the machine, gets a cool idea, and is excited. The last thing you want is for them to pause and feel the "pain" of spending cash. A frictionless, abstract payment keeps their excitement high and closes the sale at a potentially higher price point.

Why do customers prefer to pay by cash?

You might worry that by focusing on cashless, you will lose the small group of customers who still rely on cash. This fear can prevent you from upgrading your business model to improve profits and reduce operational headaches.

Some customers prefer cash for budgeting control or privacy, but this group is shrinking rapidly. In the typical high-traffic environments for vending machines—like malls, airports, and campuses—convenience and speed are what the vast majority of consumers demand.

It's a valid concern to not want to exclude any potential customers. Some people do prefer cash. However, as a business owner, you have to look at the data and the trends. Look at your target location. If you are placing a machine in a modern shopping mall, tourist attraction, or university, what is the payment behavior of the people there? The vast majority are using cards and phones for everything from coffee to clothes. The core demographic for a product like a custom phone case—younger, tech-savvy individuals—are the least likely to be carrying cash. While our PrintYOLO machines can be equipped with cash acceptors, we often advise our partners that the benefits of going fully cashless in the right environment—no cash handling, no theft risk, and higher transaction values—far outweigh the risk of losing a few cash-only sales.

Balancing Tradition with Modern Convenience

- Your Target Audience: Who is your primary customer? For tech-forward products, they are likely already cashless.

- The 80/20 Rule: Focus on serving the 80% of customers who prefer convenience and will spend more, rather than catering to the shrinking minority.

- Operational Simplicity: Going cashless eliminates the costs and labor of handling physical money, simplifying your entire operation.

Embracing cashless payments is a strategic move to increase revenue. It aligns with consumer behavior, removes spending limits, and boosts profits by making it easy for customers to say "yes."