Why Are Vending Machines Moving Beyond Coins and Cash?

You are fumbling for change at a vending machine, but you have nothing. It is frustrating. This is why modern vending machines are moving toward faster, more reliable payment methods.

Vending machines are moving beyond coins and cash because cashless payments are faster, more secure, and reduce maintenance costs. They solve the problems of coin jams, counterfeit currency and the inconvenience of carrying physical money, thus meeting the expectations of modern consumers.

For decades, the clink of a coin was the sound of a vending machine purchase. But if you're a business owner like me, you know that sound comes with a lot of headaches. It's not just about the coins themselves; it's about the entire ecosystem of handling physical cash. As someone who manufactures and operates these machines, I've seen firsthand how moving away from cash solves problems for everyone. Let’s break down exactly why moving away from physical currency, especially coins, is a smart business move that benefits both you and your customers.

Why is cash less convenient than card payments in vending machines?

Your customer wants a product, but they only have a credit card. You lose a sale. They walk away annoyed, and you miss out on revenue. Card payments turn a missed opportunity into a quick, easy transaction.

Cash is less convenient because customers are increasingly less likely to carry it. Card and mobile payments are instant, don't require exact change, and integrate seamlessly into a person's digital wallet. This capability expands your customer base to include anyone with a card or phone.

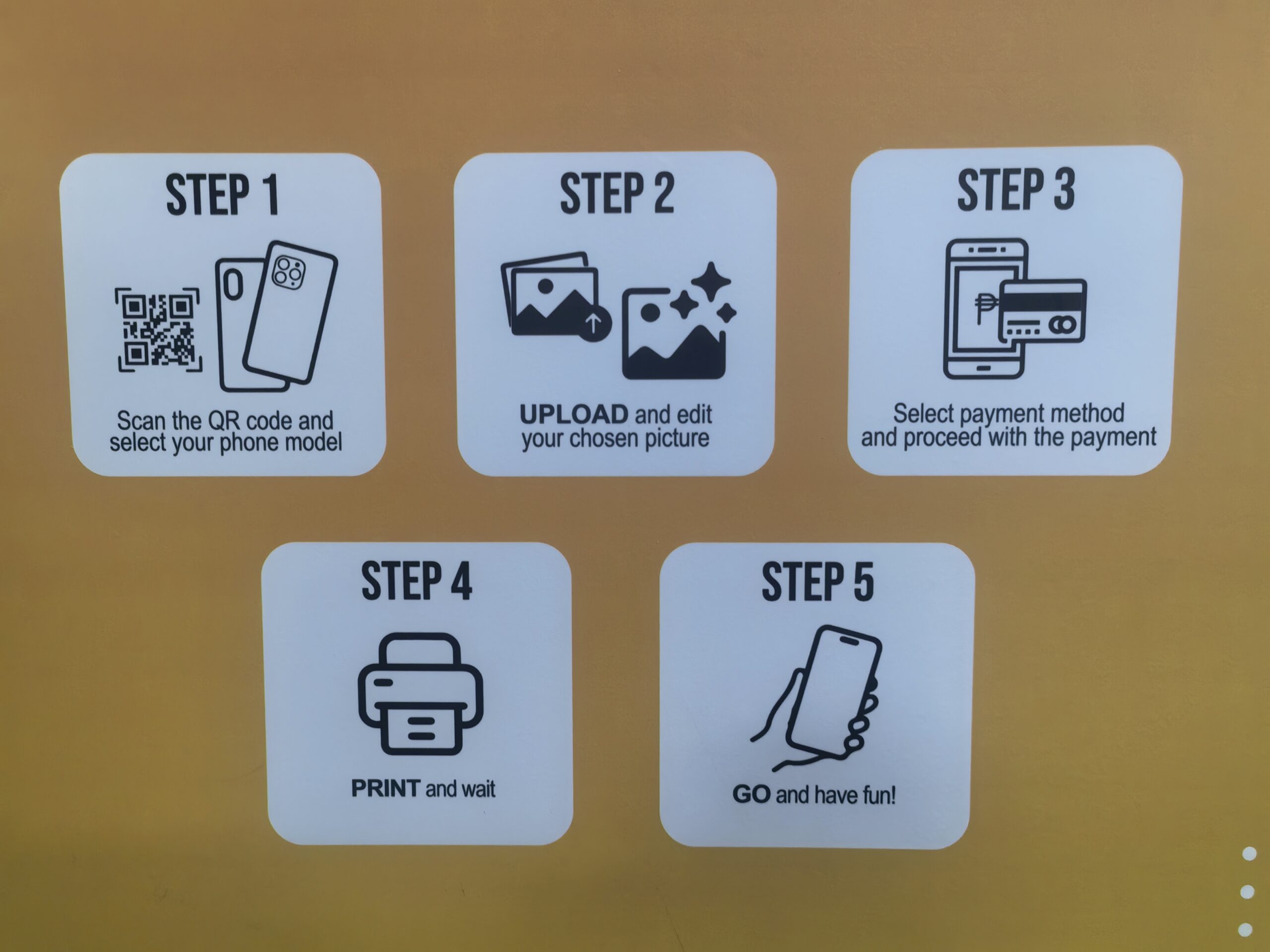

I’ve seen it happen many times at mall locations. A potential customer gets excited about our PrintYOLO phone case machine, starts designing their case, and then realizes they don't have enough cash. They walk away, and a sale is lost. Today's consumer lives on their phone and their credit card. They expect to be able to tap and go. Forcing them to use cash is like asking them to use a floppy disk to save a file—it’s just outdated. A modern product like a custom phone case deserves a modern payment method. The easier you make it for customers to pay, the more they will buy. It's that simple. Below is a quick comparison of the customer's journey.

Customer Payment Journey: Cash vs. Card

| Step | Cash Payment | Card/Mobile Payment |

|---|---|---|

| 1. Find Money | Search wallet/pockets for bills and coins. | Take out card or phone. |

| 2. Insert Money | Smooth out wrinkled bills, insert one by one. | Tap card/phone on the reader. |

| 3. Check Amount | Ensure the correct amount is inserted. | Amount is displayed and confirmed. |

| 4. Get Change | Wait for the machine to dispense coins. | No change needed. |

| 5. Potential Issue | Bill/coin rejected, machine has no change. | Transaction approved instantly. |

How does cashless payment improve transaction speed and reliability?

A long line forms at your machine during a busy time. Customers get impatient watching someone else struggle with a wrinkled bill or a rejected coin. Tap-and-go payments clear the line in seconds, maximizing your sales potential.

Cashless payments are nearly instant. A card tap or phone scan takes seconds, removing delays from inserting bills, waiting for change, or dealing with coin jams. This speed increases throughput, serving more customers in less time and improving the overall user experience.

From a technical standpoint, the difference is huge. Bill validators and coin mechanisms are mechanical devices. They have moving parts that wear down, get dirty, and jam. I've spent countless hours on service calls just to pull out a crumpled bill or a foreign coin that has shut down a whole machine. It's a constant headache. In contrast, cashless readers are digital. They are solid-state electronics with very high reliability. They connect to the network, and if there's ever an issue, it's usually a software problem that can be reset remotely. You don't have to drive across town with a toolbox. This reliability is key to keeping your revenue stream flowing without interruption.

Mechanical vs. Digital: A Reliability Showdown

| Feature | Coin/Bill Acceptor (Mechanical) | Cashless Reader (Digital) |

|---|---|---|

| Failure Rate | High (due to jams, dirt, wear) | Very Low |

| Common Issues | Rejects valid currency, fake coins, jams. | Network connectivity (rare) |

| Troubleshooting | Requires on-site physical repair. | Can often be reset remotely. |

| Downtime | Can be hours or days. | Usually minutes. |

What are the maintenance costs of handling coins versus digital payments?

You have to physically visit each machine to collect heavy bags of coins. This costs you time, fuel, and exposes you to security risks. Counting and banking it is another chore. Digital payments eliminate this entirely.

Handling coins involves significant hidden costs: physical collection, transportation, counting, and banking fees. There's also the cost of repairing coin mechanisms. Digital payments have transaction fees, but they eliminate all physical labor and maintenance, offering a lower total cost of ownership.

I remember the early days when I had to service machines myself. I would drive to a busy shopping mall with a heavy empty bag and leave with a heavier full one. A single machine could have hundreds of dollars in coins, weighing a ton. Then I had to drive to the bank, wait in line, and pay a fee to have it all counted and deposited. It would take up half my day. Now, with our PrintYOLO machines, I just check a dashboard on my phone. The money is deposited directly into my bank account. There's no physical labor, no transport costs, and no security risk. Another huge problem with coins is managing change. If a machine runs out of change, it stops working, which means another service visit just to refill the coin hopper.

The True Cost of Coins vs. Digital

| Cost Category | Coin/Cash System | Digital Payment System |

|---|---|---|

| Labor Cost | High (Collection, counting, banking) | None |

| Transport Cost | Medium (Fuel, time for site visits) | None |

| Maintenance | High (Repairing jams, refilling change) | Low (Occasional remote resets) |

| Banking Fees | Coin counting and deposit fees. | Per-transaction percentage fee. |

| Security Risk | High (Physical cash is a target) | Low (No cash on site) |

Why do businesses prefer cashless systems to reduce theft risks?

Your vending machine is a box full of cash sitting in a public place. This makes it a target for break-ins and employee theft, causing direct financial loss. A cashless machine holds no money, making it an unattractive target.

Businesses prefer cashless systems because no cash means no theft. It eliminates the risk of thieves breaking into the machine to steal money. It also removes the possibility of internal theft during the collection process, providing greater security.

Security is a major concern for any operator placing a machine in a public space like a mall, airport, or tourist spot. A machine full of cash is a magnet for trouble. I've had partners who had their machines broken into. The thieves often cause more damage to the machine than the amount of cash they steal. The repair costs and downtime are a huge loss. A cashless machine completely removes this incentive. Why would anyone break into a machine that has no money in it? Furthermore, cashless systems create a perfect digital audit trail. Every single transaction is recorded. This eliminates any risk of internal theft—you always know exactly how much money your machine has made. As a manufacturer, I want my partners to succeed. Providing them with a secure, low-risk investment is my top priority.

Securing Your Revenue Stream

- External Theft: Cash-filled machines are targets for break-ins. Cashless machines are not.

- Internal Theft: Physical cash can be skimmed during collection. Digital transactions create a perfect, unchangeable record.

- Damage Costs: A break-in attempt can destroy a machine, costing thousands to repair or replace.

- Peace of Mind: Knowing your investment and your revenue are digitally secure allows you to focus on growing your business, not guarding it.

Moving to cashless isn't just an upgrade; it's a necessary step for modern vending success. It offers better convenience, speed, lower operational costs, and much greater security for your business.