How Do Initial Costs Affect the Break-Even Point for This Vending Machine?

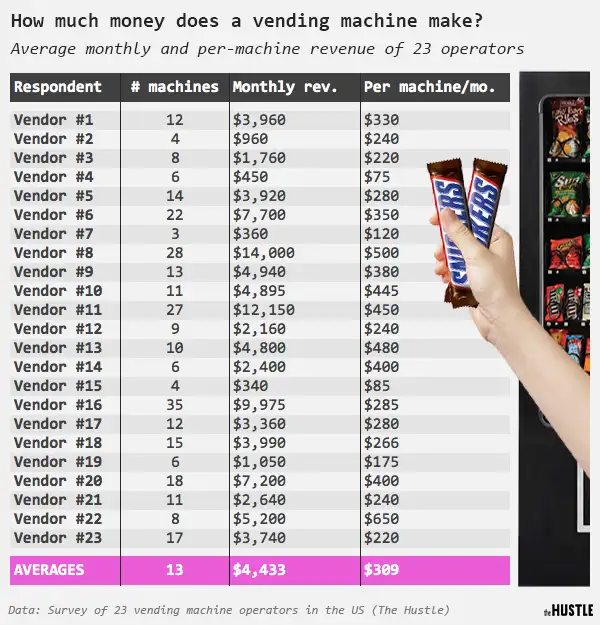

When starting a vending machine business, many entrepreneurs focus only on potential profits while overlooking the impact of initial costs. This oversight can lead to unrealistic expectations and cash flow problems.

Initial costs directly influence your break-even point by determining how many cases you need to sell to recover your investment. Higher upfront costs mean more sales required before reaching profitability.

Let's explore how different initial investments affect your path to profitability and what you can do to optimize these costs.

What Are the Key Initial Costs to Consider?

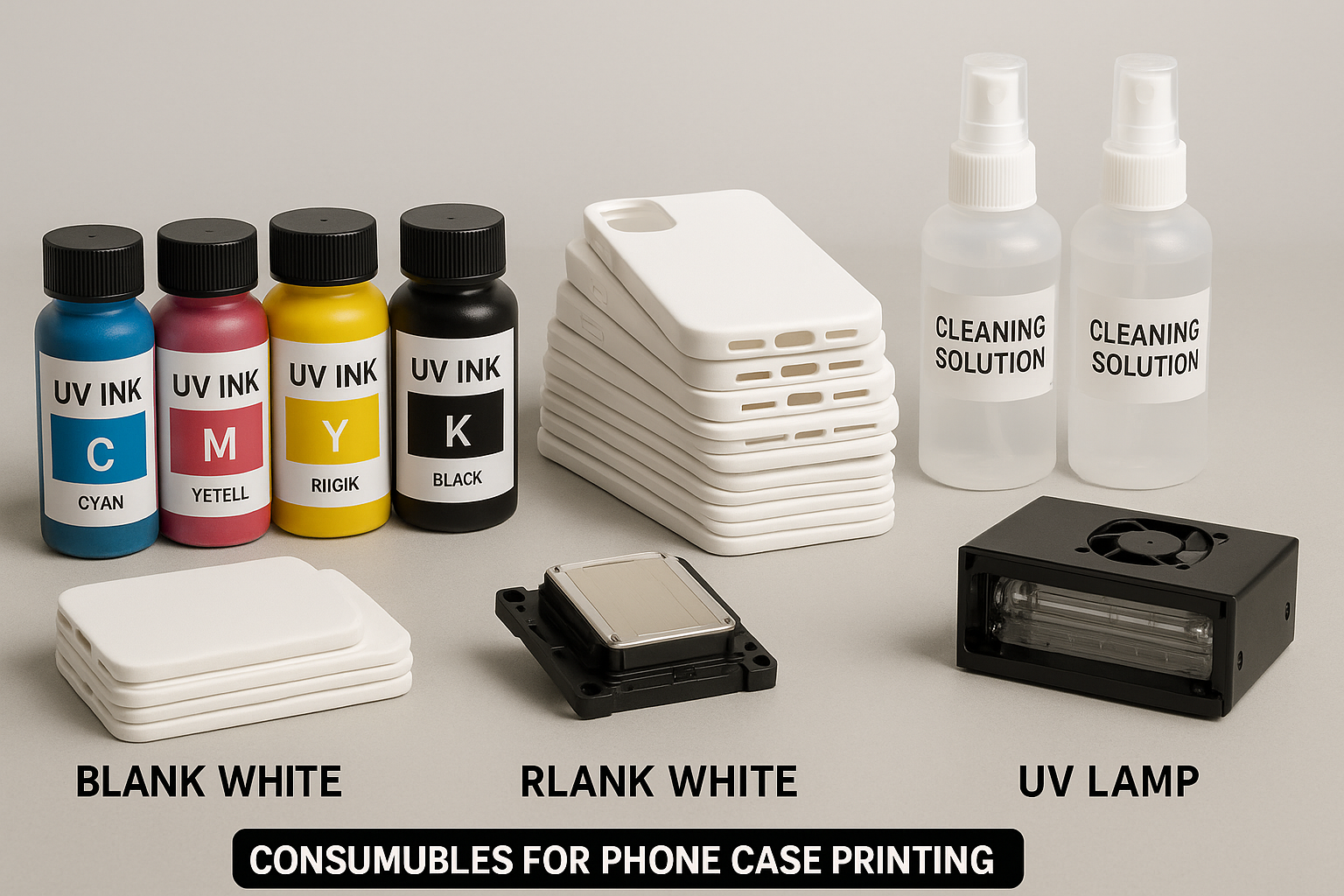

The machine purchase price is just the beginning. I've seen many operators surprised by additional startup expenses they hadn't planned for.

Essential initial costs include the machine ($8,000-12,000), installation ($500-1,000), first inventory stock ($1,000-2,000), and location setup fees ($500-2,000). These combine to form your total initial investment.

These costs form the foundation of your break-even calculation and directly impact how long it takes to start making a profit. Let's examine each component and its effect on your business timeline:

Machine Cost Options

| Purchase Type | Cost Range (USD) | Impact on Break-Even |

|---|---|---|

| New Premium | $10,000-15,000 | 4-6 months |

| Standard New | $8,000-10,000 | 3-5 months |

| Refurbished | $5,000-8,000 | 2-4 months |

| Leased | $300-500/month | 1-2 months |

Additional Setup Costs

| Component | Cost Range | Necessity |

|---|---|---|

| Installation | $500-1,000 | Required |

| Initial Stock | $1,000-2,000 | Required |

| Location Fee | $500-2,000 | Variable |

| Marketing | $300-800 | Recommended |

How Can You Optimize Initial Costs?

Every dollar saved in initial costs brings you closer to profitability. I've learned that smart cost management at the start makes a huge difference.

There are several strategies to reduce initial costs without compromising quality, including bulk purchasing, negotiating with suppliers, and choosing optimal payment terms.

Here are effective ways to manage your initial investment:

Cost Reduction Strategies

| Strategy | Potential Savings | Impact |

|---|---|---|

| Bulk Purchase | 10-20% | Reduced unit cost |

| Supplier Negotiation | 5-15% | Better terms |

| Lease vs Buy | Varies | Lower upfront cost |

| Location Bundle | 10-30% | Reduced setup fees |

Financial Planning Considerations

- Calculate total investment needed

- Include buffer for unexpected costs

- Consider financing options

- Plan for maintenance reserves

- Account for seasonal variations

- Budget for marketing expenses

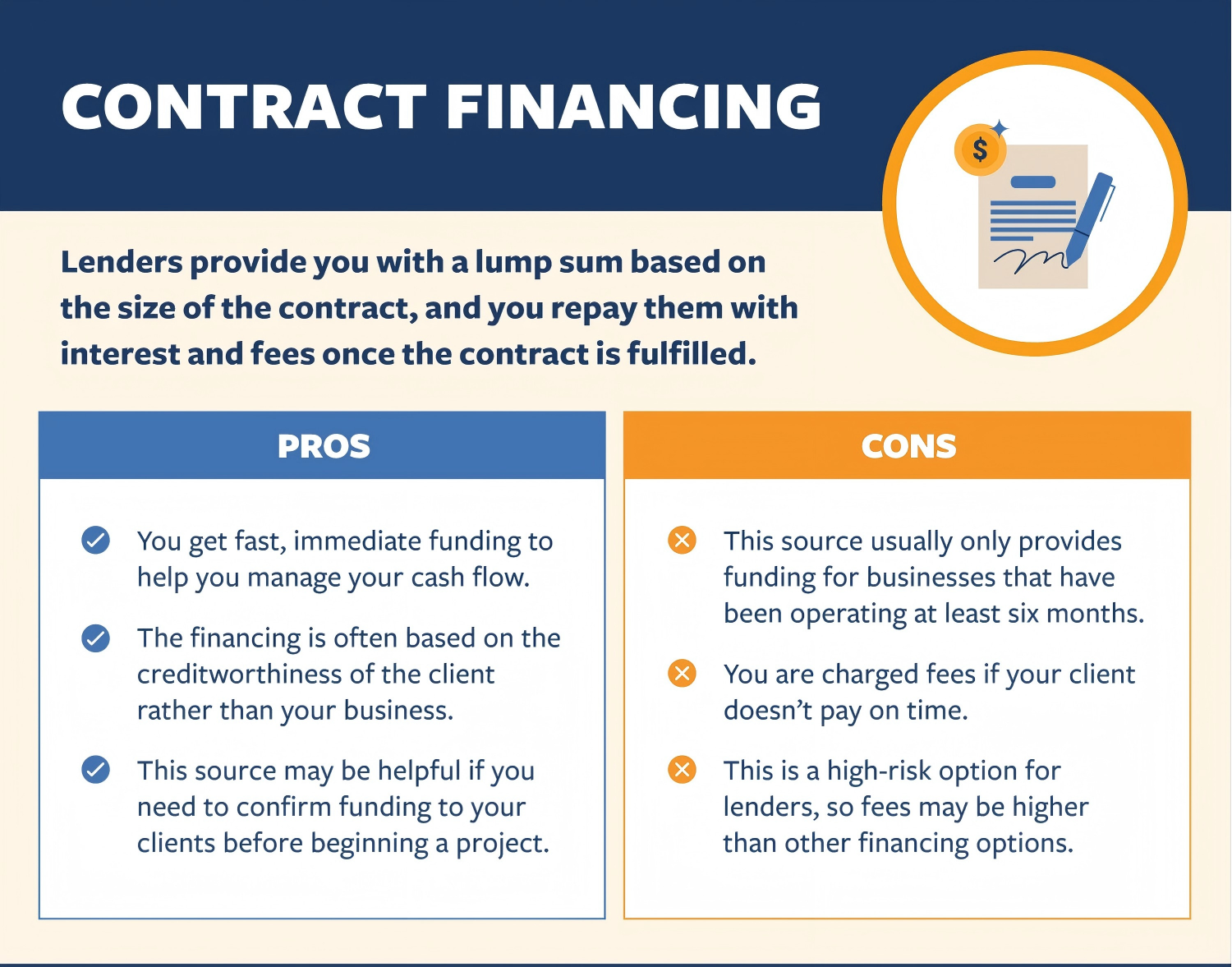

What's the Best Way to Finance Initial Costs?

Smart financing can significantly impact your break-even timeline. I've seen various approaches work depending on individual circumstances.

Different financing options affect your monthly costs and overall profitability. Understanding these options helps choose the best path for your situation.

Financing Options Comparison

| Method | Pros | Cons |

|---|---|---|

| Cash Purchase | No debt, full ownership | Higher upfront cost |

| Bank Loan | Lower monthly payment | Interest costs |

| Supplier Financing | Often easier to obtain | May have higher rates |

| Lease-to-Own | Lower initial cost | Higher total cost |

Understanding and managing initial costs is crucial for success in the vending machine business. Focus on optimizing these expenses while maintaining quality to achieve faster profitability.