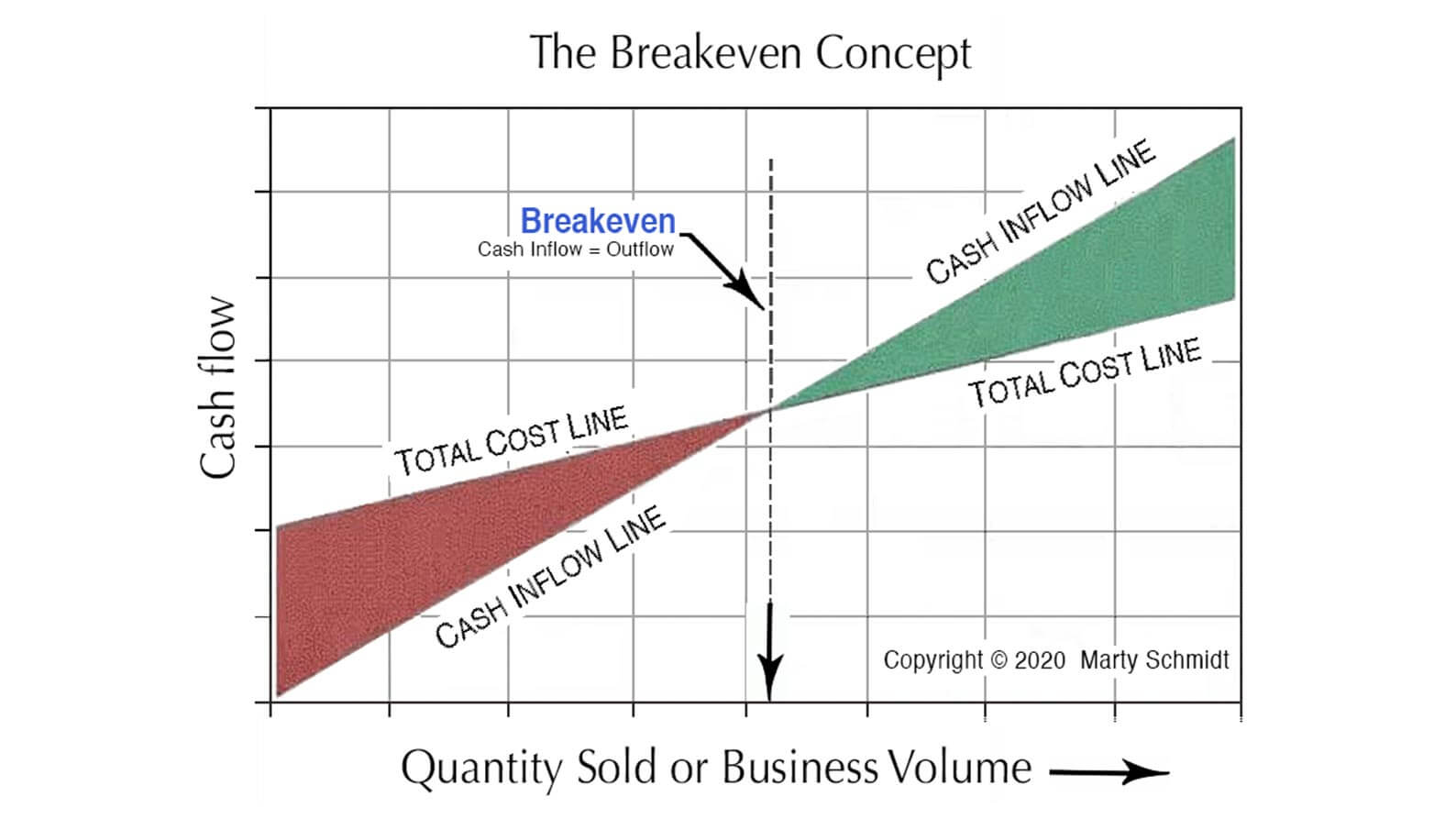

How Can Reducing Upfront Costs Shorten the Break-Even Timeline?

Starting a vending machine business often feels overwhelming due to high initial costs. Many operators struggle with large upfront investments that delay their path to profitability.

Reducing upfront costs can significantly shorten your break-even timeline by lowering the total amount you need to recover through sales. Every dollar saved in initial costs means one less dollar to earn back before becoming profitable.

Let's explore practical ways to reduce your startup costs and reach profitability faster.

What Are the Most Effective Ways to Cut Initial Costs?

High upfront costs can drain your resources and extend your break-even timeline unnecessarily. I've found several proven strategies to reduce these initial expenses.

The most effective cost-cutting methods include leasing instead of buying, negotiating with suppliers, and choosing cost-effective locations. These approaches can reduce your initial investment by 30-50%.

Let's analyze the various ways to reduce upfront costs and their impact on your break-even timeline:

Traditional vs. Optimized Cost Structure

| Cost Component | Traditional Cost | Optimized Cost | Savings |

|---|---|---|---|

| Machine Purchase | $12,000 | $8,000 | $4,000 |

| Installation | $1,000 | $500 | $500 |

| Initial Stock | $2,000 | $1,000 | $1,000 |

| Location Setup | $2,000 | $1,000 | $1,000 |

These reductions can significantly impact your business timeline:

- Lower machine costs through bulk purchasing or refurbished options

- Reduced installation fees by coordinating multiple installations

- Optimized inventory levels to minimize initial stock investment

- Negotiated location fees with property managers

- Streamlined marketing costs through digital channels

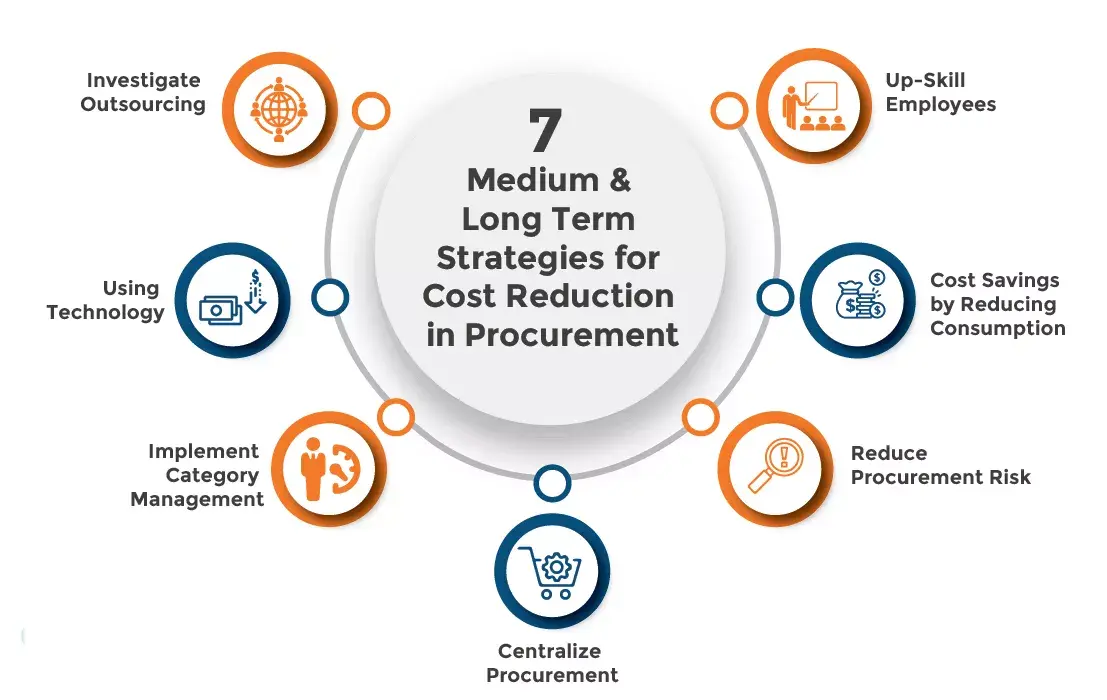

Where Can You Find Hidden Cost Savings?

Many operators overlook potential savings opportunities. I've discovered that small changes in multiple areas can add up to substantial cost reductions.

Hidden savings often come from unexpected places like supplier relationships, timing of purchases, and creative location arrangements. Combined, these can reduce your initial investment by 15-25%.

Understanding where to look for savings requires examining all aspects of your startup costs:

Cost Reduction Opportunities

| Area | Potential Savings | Strategy |

|---|---|---|

| Equipment | 20-30% | Bulk orders, timing purchases |

| Installation | 30-50% | Multi-unit deals |

| Location | 15-25% | Long-term commitments |

| Supplies | 10-20% | Direct sourcing |

Consider these additional strategies:

- Partner with complementary businesses

- Share transportation costs

- Utilize seasonal promotions

- Leverage supplier relationships

- Monitor market conditions for optimal purchase timing

- Explore alternative payment arrangements

- Implement efficient inventory management

How Does Cost Reduction Impact Long-Term Success?

Smart cost reduction doesn't just speed up break-even - it builds a foundation for sustainable profits. I've seen businesses thrive by starting lean and growing strategically.

Reduced initial costs allow for more flexible pricing strategies and better cash flow management. This flexibility often leads to faster market adaptation and stronger competitive positions.

Dive Deeper:

Let's examine the long-term benefits of reduced upfront costs:

Impact on Business Performance

| Metric | High Cost Start | Low Cost Start |

|---|---|---|

| Break-even Time | 6-8 months | 2-4 months |

| Cash Flow | Tight | Flexible |

| Growth Potential | Limited | Enhanced |

| Risk Level | High | Moderate |

The advantages extend beyond just faster break-even:

- More resources for marketing and promotion

- Better ability to handle seasonal fluctuations

- Increased capacity for expansion

- Reduced financial stress

- Greater pricing flexibility

- Improved competitive position

- Enhanced ability to adapt to market changes

Remember, reducing upfront costs doesn't mean compromising quality. Focus on smart reductions that maintain service standards while accelerating your path to profitability.